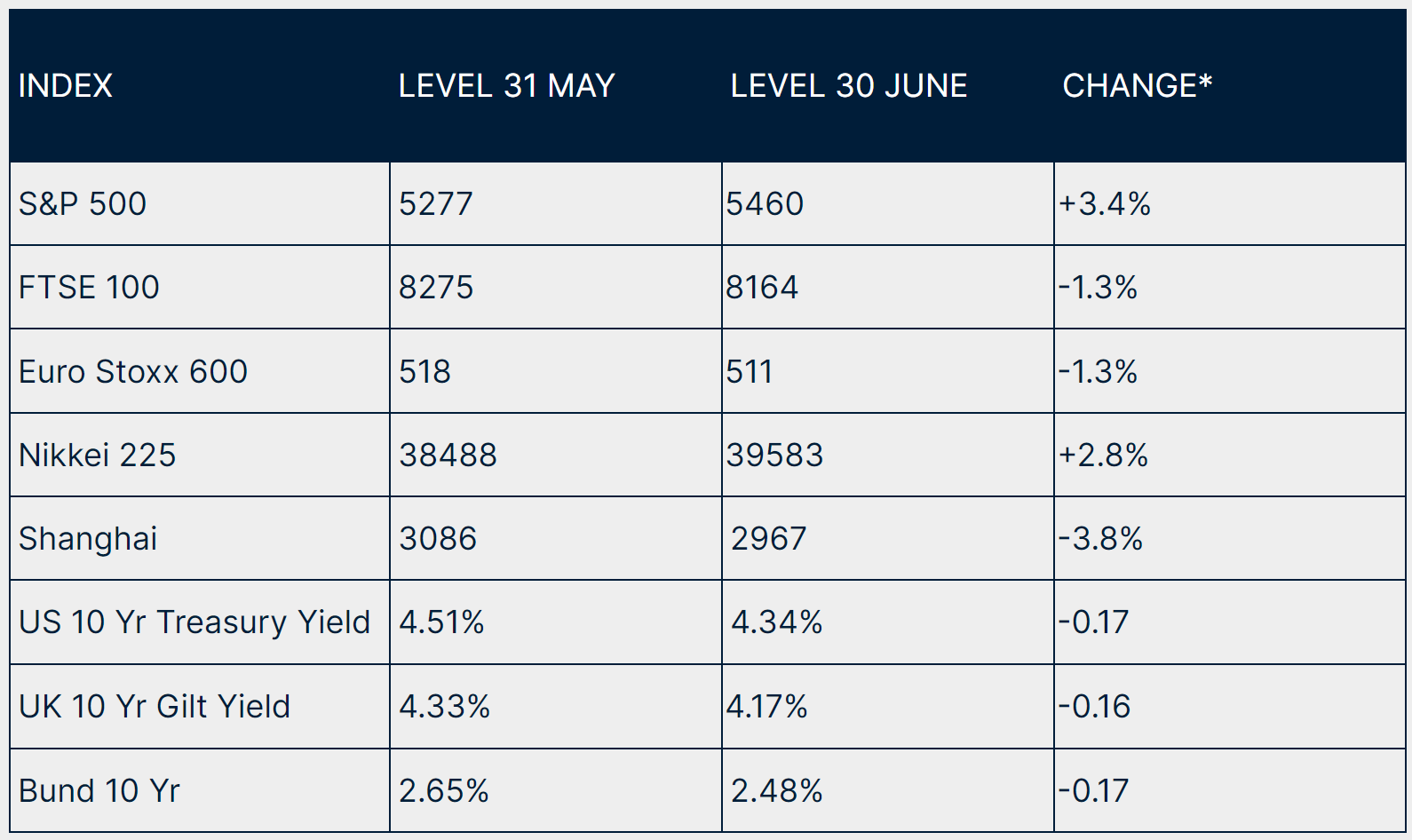

Investment Update: July 2024

*All returns in local currency terms

Overview

The news flow in June was dominated by politics, as elections and their potential outcomes took centre stage. In India, President Modi lost his overall majority, in the UK prospects of a labour government seemed likely and in the US, the first TV debate between Biden and Trump proved challenging for the Democrats. However, it was only the snap election called in France by President Macron that had any significant effect on markets, as the prospect of either the extreme left or right leaning parties obtaining power rattled European bonds and French equities. This also has the potential to have the most significant impact in the future, as the outcome could create a seismic shift within the EU itself. Meanwhile, in the US, technology stocks continued to drive the market forward, with Nvidia once again leading the way. Needless to say, this all led to the performance of equity markets being mixed across regions. However, despite the political backdrop, bond markets continued their upward trend, as optimism returned about the inflationary outlook and we saw interest rate cuts in Europe and elsewhere.

United States

The US Presidential election campaign kicked off earlier than is customary with a TV debate gauntlet laid down by President Biden to his main contender, Donald Trump. The performance differences were marked and assuming voter reactions are carried forward to the ballot box we can anticipate President Trump’s return in January 2025. There is, however, speculation that Biden could be replaced as Democrat leader during the August convention. Both contenders plan to spend around $6 trillion, albeit in different ways but the deficit implications are not radically different. As previously mentioned, the main market pushed ahead, but in a narrow range of stocks, with mid and small cap indices down over the month. Valuations for the S&P 500 are high and progress is dominated by larger firms with the stock market darling Nvidia market capitalisation valued higher than all UK stocks combined. A slip in earnings progress could bring prices lower.

The main economic drivers persist in good shape with Personal Consumption Expenditure (PCE) inflation falling in line with expectation, close now to the Federal Reserve’s 2% target, although wage inflation continues to be an issue. The market anticipates two interest rate cuts this year, which may well be reduced to a single cut if the economy remains strong. There has been some early weakness in the labour market and we continue to monitor developments. Should weakness develop here, the likely reaction of the Federal Reserve would be to cut rates more quickly, although Treasury yields of around 4.3% for the 10-year bond suggest nothing radical. Likewise, the business cycle in America, denoted by the Institute of Supply Management study is enjoying an expansion.

Europe

As expected, the European Central Bank (ECB) cut interest rates and ahead of the US for a change. The continued dichotomy between economies, particularly with continued weakness in Germany, lends support to this move; but Christine Lagarde made it clear that any future cuts would be dependent on inflation data. However, the positive move on interest rates was overshadowed by a poor performance from President Macron’s Ensemble party in the European Parliamentary elections. The resulting snap election for the French parliament called by Macron has proved a disastrous decision and the country. At one point the French CAC index was down 6% and bond yields rose to near that of Italy’s.

United Kingdom

At home, markets were sanguine about the prospect of a labour Government, which at the time of writing has proven to be the result. Sir Keir Starmer has moved his party to a more centrist position and has made it clear that he intends to be fiscally responsible. The ten-year gilt yield, indicative of the medium term interest rate the government can borrow money at, fell during the month - indicating markets were not expecting any negative surprises on the fiscal front, which is reassuring. Market attention was more focussed on the anaemic GDP growth rate which - although revised up - is still below 1%, as well as the latest inflation picture. Whilst headline inflation now appears to be in line with the Bank of England’s target, wages in the service sector are still rising at a rate of over 5%. This led the bank’s monetary policy committee to keep any rate cuts on hold and it is the incoming government that will feel the benefit of any future rate cuts.

Japan

Japanese equities had a strong month, however this came at the expense of a continued decline in the value of the yen, as the currency tested the lows against the US dollar seen in May, which caused a $60bn intervention from the Bank of Japan. While there was no evidence of further intervention in June, the Ministry of Finance appointed a new currency czar, replacing the incumbent vice finance minister for foreign affairs. While a weaker yen increases the competitiveness of Japan’s exporters, it does create inflationary pressures which, while previously welcomed after decades of deflation, does create issues for the economy. The currency’s problem is that investors can benefit from the ‘carry’ trade between the dollar and the yen (trading the large differential between the respective countries’ interest rates), so until US rates fall and Japan’s rise, it makes it difficult for interventions to succeed.

Asia and Emerging Markets

Once again, a mixed picture emerged in Asia, as issues over the property market bubble return to dominate investors thinking. The initial positive effect of government policies that were announced to address the property market have clearly worn off, as worries persist about the level of financial support proposed being sufficient to fix the debt overhang. The consequent devaluation of the yuan continues to benefit exporters, but unlike Japan, there is resistance to Chinese exporters benefitting their improved competitiveness, as the US and Europe continue to impose tariffs on Chinese goods. Elsewhere, we saw the Taiwanese and Korean markets follow the US lead, with information technology stocks driving the markets there higher. The stock market in India, having fallen significantly immediately following the shock election result there, recovered strongly through June to make India one of the better performers over the month as a whole.

Rockhold Asset Management, with contribution from Alpha Beta Partners, LGT and Marlborough, July 2024.

Disclaimer: This document is issued by Journey Invest Limited. Its content is for your general information purposes only and does not constitute investment advice. The commentary is intended to provide you with a general overview of the economic and investment landscape. It is not an offer to purchase or sell any particular asset and it does not contain all of the information which an investor may require in order to make an investment decision. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of this article.

Past performance is not a reliable indicator of future results. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances. Your capital is at risk and the value of investments, as well as the income from them, can go down as well as up and you may not recover the amount of your original investment.