Investment Update: May 2024

Overview

Following consecutive monthly returns since the start of the year, we saw a mixed picture in April, with markets that had previously led the way - notably the US and Japan - falling back. This was mainly due to expectations over the extent and timing of interest rate cuts in the US, which had been optimistic. This particularly impacted lower risk portfolios which have higher levels of bond fund holdings, as we saw bond yields edge up in western economies (bond prices move inversely to yields). It seems that the higher level of economic growth in the US is causing the level of inflation to remain higher than expected. This is not the case for the UK and Europe, so there is every possibility that rates will start to decline here earlier than in the US.

Geopolitics also played a part, as we saw heighted tensions in the Middle East impact sentiment and oil prices as Iran and Israel traded missile and drone attacks on each other’s home soil for the first time. However, as the month drew on fears of further escalation abated and we saw the oil price fall back as a consequence.

United States

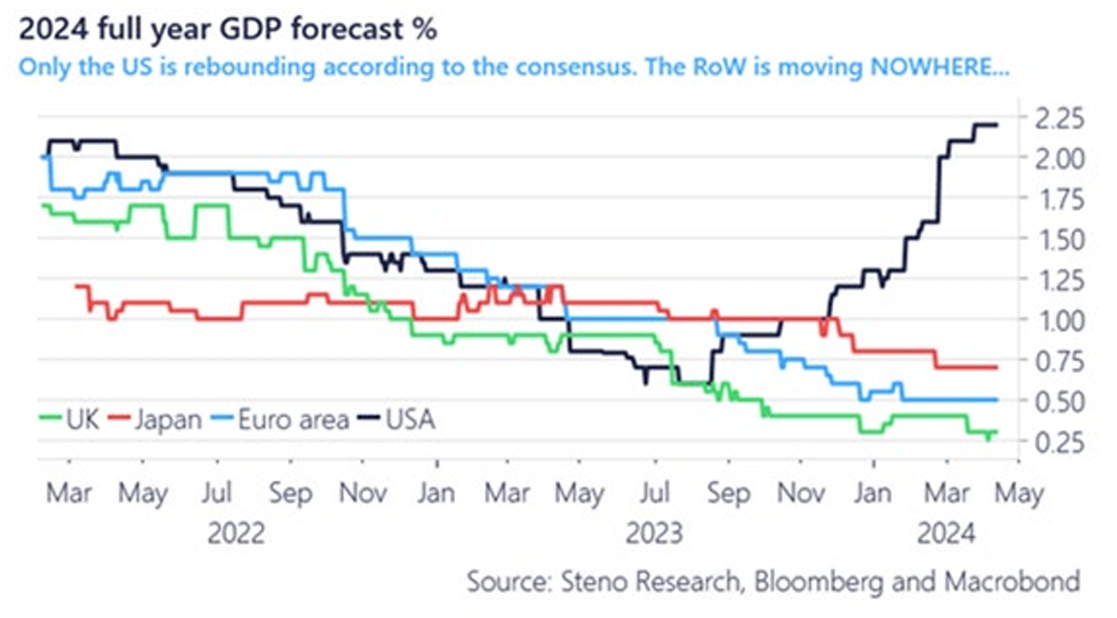

The US economy remains resilient, with a strong job market bolstering consumer spending. Non-farm payrolls and retail sales both came in strong and manufacturing activity ticked into positive territory for the first time since October 2022. First quarter GDP growth increased at a 1.6% annual rate in the first three months of the year. While this is below expectations and lower than the prior quarter, the economy remains robust. This is in contrast to the rest of the world (RoW):

The Consumer Price Index (CPI) data came ahead of expectations at 3.5% year-over-year (YoY), while the Fed’s preferred inflation gauge, the Personal Consumption Expenditures Core Price Index (PCE) remained at 2.8% YoY in March.

These data points indicate that inflation remains persistent, which has stalled the Fed’s efforts to combat inflation. Consequently, the Fed will be in no rush to cut rates, and markets are now predicting just one rate cut by year-end, a far cry from the seven rate cuts initially priced in at the end of 2023. This drove 10-year Treasuries up 0.48% to 4.68% in April, while two-year Treasuries closed above 5%.

Source: Bloomberg

Broadly, first quarter earnings results have been positive, and going forward the focus is likely to be on margin management - minimising costs in order to maximise profit. Despite this positive sentiment, higher inflation and lower-than-expected GDP growth meant US equities lagged most other regions in April.

Europe

Eurozone GDP grew by 0.3% in the first quarter of 2024, which was above market expectations of 0.1% growth and an improvement on the final quarter of 2023. This was largely due to higher than expected economic growth in Germany, France, Italy and Spain. Inflation data continues to support the case for the European Central Bank (ECB) to cut interest rates in June. Core inflation, which filters out food and energy prices, eased to 2.7% in April. This was slightly above forecasts of 2.6%, but lower than March’s reading of 2.9%, meaning year-on-year core inflation has now been falling since July.

United Kingdom

At home, the UK has seen pleasing reports that inflation is falling towards the Bank of England target with added momentum. The Consumer Prices Index (CPI) rose by 3.2% in the 12 months to March 2024, down from 3.4% to February and well below its recent peak of 11.1% in October 2022. Services inflation remained higher at 6%, primarily due to ongoing wage inflation. The British Retail Consortium reported that food price inflation had fallen to 3.4%, the lowest level in two years. April’s UK CPI inflation rate is expected to ease further towards 2% as typical energy bills drop by just over 12% after regulator Ofgem reduced the energy price cap to its lowest level in two years. Both consumers and businesses are reacting to the lower inflation environment, as evidenced by consumer confidence hitting a two-year high. Additionally, the UK's Composite Purchasing Managers’ Index (PMI) survey scored 54, the highest level among G7 countries (a reading of over 50 being viewed as positive for the economy).

The leading UK equity index, FTSE 100 has surpassed an all-time high and the smaller company FTSE 250 has crossed over into an expansionary phase – long overdue, but pleasing all the same. Likewise, it is becoming increasingly likely that the Bank of England will move rates lower in the coming months.

Japan

Japanese equities followed a similar downward trend to US and European equities, with the best performing sector being larger capitalisation value companies. The focus of investors is now shifting to see if the government steps in to defend the depreciating yen against the US dollar. Recent weakness saw the exchange rate briefly dip to 160 yen to the dollar, with rumours that the Japanese government intervened in the market by buying yen. The exchange rate subsequently corrected back to 155 yen to the dollar. Recent industrial production figures rose by 3.8% (month over month) in March, which was stronger than expected. However, retail sales growth slowed in the same month.

Asia and Emerging Markets

Asia and emerging markets (EMs) outperformed developed markets in April, helped by a strong performance from China, which outpaced the wider EM benchmark as investors became more optimistic about the economic outlook. China is mustering for an aggressive expansion in manufacturing-led exports. Significant debts and bankruptcies in the real estate sector have stymied her post-pandemic recovery. Consequently, a move to undercut western rivals in the production of battery electric vehicles and the production of infrastructure and key components in the drive for zero carbon emissions is the ambition. China’s modern automated factories and cheap labour will be supported by a likely currency devaluation making prices to market even more appealing. China’s GDP grew by 5.3% in the first three months of this year and a Bloomberg survey of 15 economists put expectations of GDP growth this year at 4.8%. The People’s Bank of China kept its medium-term lending rate on hold. Latin America is still leading the global monetary easing cycle, although Argentina was the only country to cut rates in April.

Disclaimer: This document is written by our investment partners Rockhold Asset Management Ltd. Its content is for your general information purposes only and does not constitute investment advice. The commentary is intended to provide you with a general overview of the economic and investment landscape. It is not an offer to purchase or sell any particular asset and it does not contain all of the information which an investor may require in order to make an investment decision. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of this article.