Investment Update - October 2024

*All returns in local currency terms

Overview

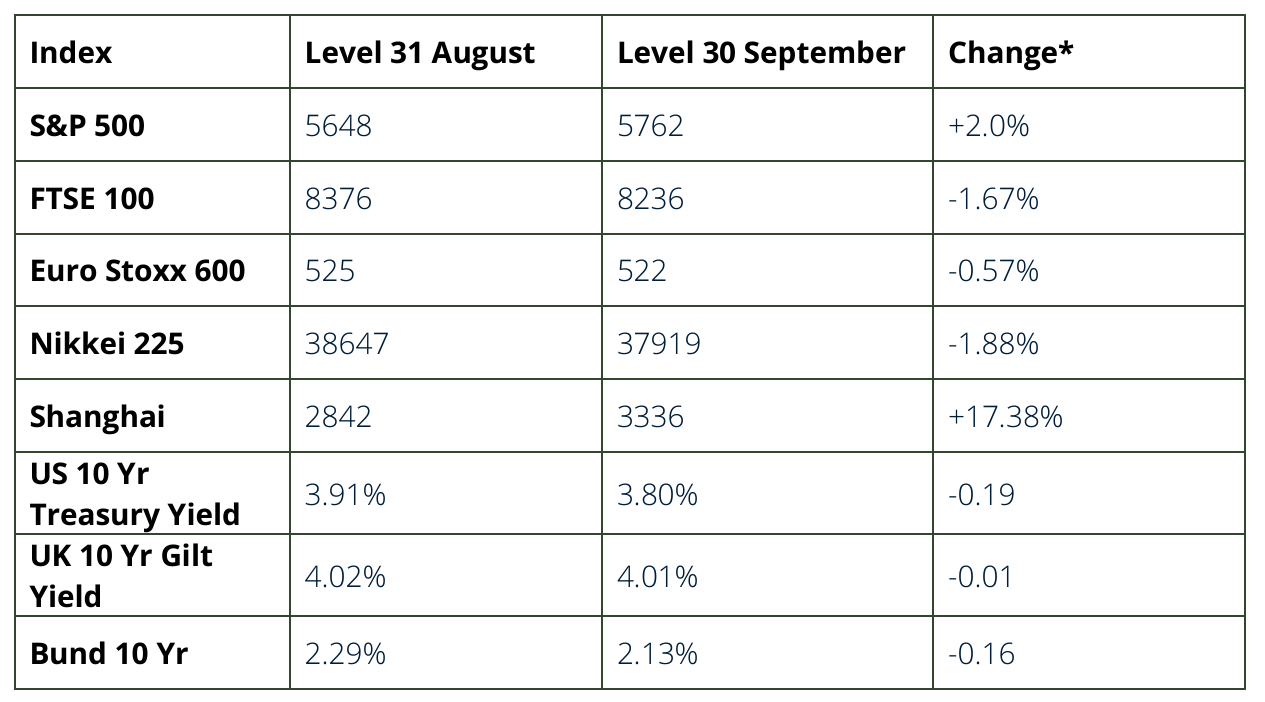

A larger than anticipated cut in US interest rates and a surprise fiscal stimulus package from the People’s Bank of China (PBC) acting together with financial regulators, were the dominant themes during the month. September has a nasty habit of being difficult for equity markets and we saw them living up to that reputation, as they initially declined. However, the scale of the US rate reduction saw a complete reversal of fortunes there. One downside of this was the strength of the pound against both the dollar and euro, which dampens returns from assets priced in these currencies for sterling investors. Fixed interest stocks continued to do well in portfolios, as the prospects for lower interest rates boosted their attractiveness, particularly in the US and Europe.

United States

The US Federal Reserve finally cut interest rates by a higher than expected 0.5%, as they attempted to navigate a ‘soft landing’ for the US economy. Weaker jobs data of late probably prompted the faster move on interest rates, especially as the inflation rate continued to hover around the 2% target rate; subsequent comments from Fed officials indicated that the future pace of cuts would be slower. The Fed’s own projections now seem to suggest that rates will be 2% lower than where they were before September’s cut by the end of 2025. At the stock market level, once again we saw the equally weighted S&P 500 outperform the market capitalisation weighted version (the former index is constructed so that each of the 500 stocks in the index contribute equally to returns, whereas the latter can be skewed by the impact of a few large companies). Indeed, both the equally weighted version and the Russell 2000 (small companies) index outperformed the S&P 500 over the quarter, which confirms that returns have widened out beyond the so-called ‘Magnificent 7’ stocks:

Source: Morningstar

United Kingdom

The Bank of England’s decision to keep interest rates on hold, coupled with uncertainty over the UK Government’s future spending and taxation plans, served to keep both government bond yields higher and the pound stronger. The currency sensitive FTSE 100 struggled in comparison to the Mid-Cap weighted FTSE 250 index, which rose slightly over the month. The companies in the FTSE 100 index derive over 80 percent of their earnings from overseas, so can suffer with a stronger pound; whereas mid and small-sized companies tend to benefit. With the budget on October 30th, it is widely expected to include significant changes to capital taxes and possibly fiscal accounting rules. Bond markets are likely to be sensitive to any apparently unfunded policies.

Japan

The appointment of an outsider as Prime Minister and his immediate announcement of a snap election, led to another bout of intra-month volatility. The new PM, Shigeru Ishiba, has been quite vocal in his demands for increases in corporation tax and has asked for a reset of defence relations with the US. Markets, therefore, worried about the impact on future corporate earnings. Meanwhile, inflation remains steady at 3% and, although above the Bank of Japan’s target, they seem to not be in a hurry to increase rates to counter this. This is perhaps understandable given the weakness of the domestic economy.

Asia and Emerging Markets

The PBC, together with regulators, surprised markets with a significant economic stimulus package designed to boost China’s domestic demand; support the beleaguered property market; and revive the stock market, which has been in decline for the past three years. The measures - which included lowering bank lending rates and setting up £53bn facility to support the equity market - certainly had the desired effect. Time will tell, but Chinese stocks rebounded meaningfully higher by the month’s end and should have a positive knock-on impact in the pacific emerging markets region as a whole. Several regional markets rallied over the month, although Korea and Taiwan were dragged lower by the waning AI trade globally. Growth in China fuelled by liquidity will naturally be good news for global growth and will be felt at portfolio level. A weaker dollar, if delivered, will also assist the emerging world. China’s competitive edge remains lower prices which also helps suppress inflation in the West.

China’s stock market gains from stimulus:

Source: Morningstar

Outlook

Geopolitics is impossible to model within portfolios. Random events in the United States cannot be ruled out, particularly with 2 attempts to silence Mr Trump. Middle Eastern events are well publicised and need little further extrapolation, other than the potential impact on the oil price, which could negatively affect the global economy if the price continues to rise significantly. Likewise, the ongoing war in Ukraine. At portfolio level an important observation is linked with the fall in inflation and the impact that brings to the relationship between equities and fixed income. Fixed income typically acts as a stabiliser in portfolios, providing a cushion against equity price declines by reducing volatility. However, this relationship was disrupted in the past 2-3 years due to high inflation. Fortunately, the long-term stabilising role of fixed income is now returning to normal, which is a positive development. Portfolios have benefitted from the rise in valuations and the reduction in global interest rates. Returns are positive for the year, with the probability of further growth in sight, notwithstanding unforeseen events of a geopolitical nature.

Rockhold Asset Management, with contribution from Alpha Beta Partners, Marlborough and LGT, September 2024

Disclaimer: This document is issued by Journey Invest Limited. Its content is for your general information purposes only and does not constitute investment advice. The commentary is intended to provide you with a general overview of the economic and investment landscape. It is not an offer to purchase or sell any particular asset and it does not contain all of the information which an investor may require in order to make an investment decision. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of this article.

Past performance is not a reliable indicator of future results. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances. Your capital is at risk and the value of investments, as well as the income from them, can go down as well as up and you may not recover the amount of your original investment.