A perspective on market turmoil

The sudden sell-off in global markets in early August took many investors by surprise – and there could be further volatility in the months ahead.

Stock markets globally have declined sharply in recent weeks. On August 5th, Japan’s Topix index fell 12% in one day, with the VIX reaching levels not seen since the early COVID-19 pandemic and the 2008 Lehman Brothers collapse. Since the peaks of mid-July, Japan’s Topix and America’s NASDAQ have faced significant double-digit losses. Nvidia has lost about 25% of its value, whilst Arm is down more than 40%. Additionally, American banking stocks decreased by 9% in just a few days.

The Economist (Money Talks, August 8th 2024) cites three developments that have led to this turmoil: waning enthusiasm for artificial intelligence; a shift away from trades reliant on a weak Japanese yen and dovish Bank of Japan policies; and concerns over a weaker American economy following a disappointing jobs report on August 2nd. Individually, each of these factors might have prompted a localized sell-off. Together, they have pushed global markets into "risk off" mode, prompting money managers to reduce exposure. This led to near-indiscriminate selling that big funds may yet continue. The mood has changed, and such volatility rarely ends quickly.

How to react when volatility hits and market ‘noise’ abounds?

Experience dictates that maintaining a long-term focus and sticking with investment strategies is paramount when markets turn turbulent.

Don’t let turbulence distract. Stay focused on the long term.

Short-term volatility is normal; despite ups and downs, equity markets generally rise over time.

Notes: The chart shows the trailing 30 business day volatility of daily returns (LHS) and the price index (RHS) of the MSCI World Price Index from 1 January 1982 to 31 December 1987 and the MSCI AC World Price Index thereafter.

Source: Vanguard / Refinitiv, 2024.

Downturns aren’t rare events. Investors will endure many during their lifetime.

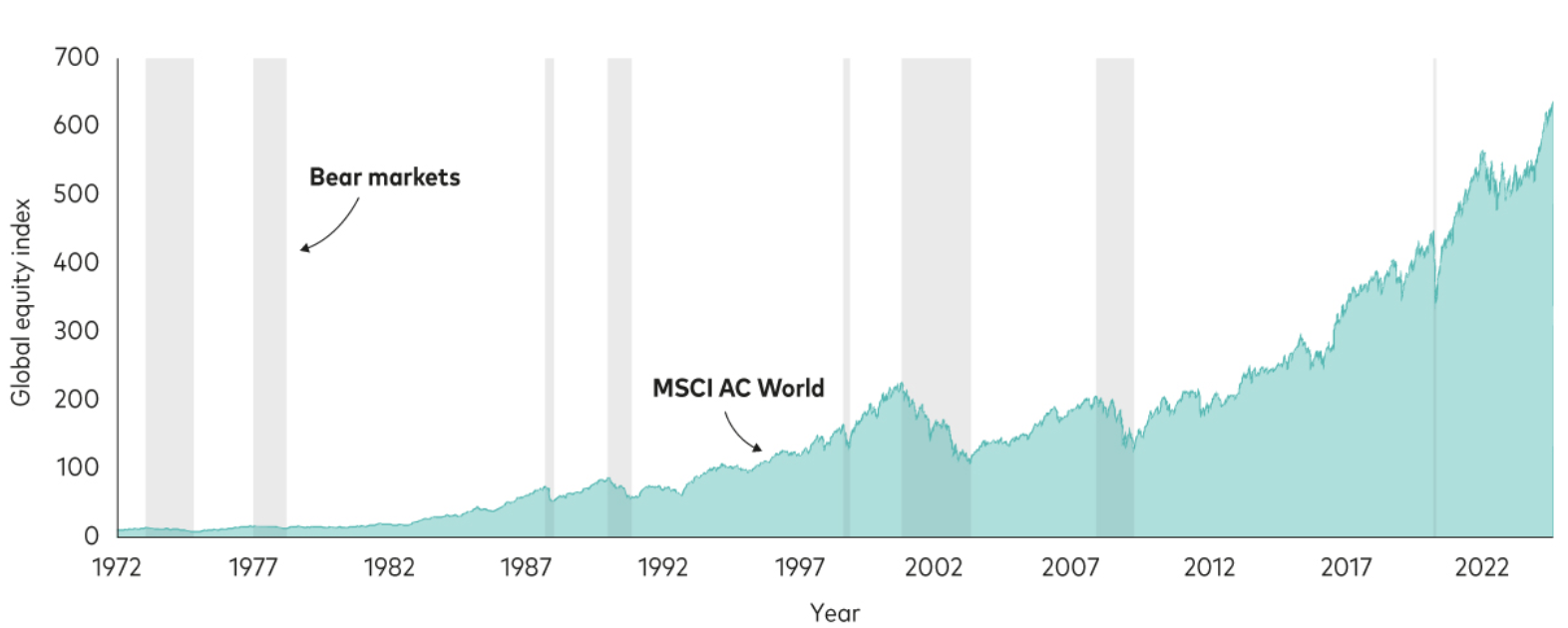

Bear markets and corrections are normal for investors. Since 1972, global equities have experienced eight bear markets. Historically, equities recover and achieve strong long-term results.

Notes: The chart shows the MSCI World Price Index from 1 January 1972 to 31 December 1987 and the MSCI AC World Price Index thereafter. The shaded areas represent bear markets, defined as price decreases of more than 20% from the previous peak to the trough

Source: Vanguard / Refinitiv, 2024.

Market timing is futile; the best and worst trading days tend to occur close together.

Investors should avoid timing the market, as it risks missing strong performance that is crucial for long-term success. Historically, the best and worst trading days cluster during brief, uncertain periods, making successful timing unlikely.

Notes: The chart shows daily returns of the MSCI World Price Index from 1 January 1980 to 31 December 1987 and the MSCI AC World Price Index thereafter. The green bars highlight the 20 best trading days since 1 January 1980 and the gold bars highlight the 20 worst trading days since 1 January 1980.

Source: Vanguard / Refinitiv, 2024.

Avoid panic-selling during market turmoil.

Fast and significant market downturns are rare, but when they happen, investors may panic and shift to cash, complicating the timing of re-entry. Prolonged absence from the market can exacerbate problems.

Notes: The chart shows the distribution of excess returns of cash over a global 60% equity / 40% fixed income portfolio for the 3-, 6- and 12-month periods after 2-month total returns of global equities were below 5%. For example, global equity returns from 31 August 2008 to 31 October 2008 were -20.74%. Over the following 3-month period until 31 January 2009, cash returned 0.84%, while the 60/40 portfolio returned 1.76%, so that the excess returns of cash were at -0.93%. Equity comprises global equity (MSCI AC World Total Return Index). Fixed income comprises hedged, global bonds (Bloomberg Global Aggregate Bond Index Sterling Hedged). Cash is represented by Sterling 3-months deposits. Data based on the period between 31 January 1990 and 30 June 2024.

Source: Vanguard / Refinitiv, 2024

What to do when volatility hits? Tune out the noise to prevent hasty decisions that could lead to mistakes; if market corrections cause stress, reassess your tolerance for risk; and stay diversified, maintaining a balanced portfolio - bonds can stabilise during downturns, while international markets may perform well when others don’t.

Disclaimer: Any information contained within this article is of a general nature and should not be construed as a form of personal recommendation or financial advice. Nor is the information to be considered an offer or solicitation to deal in any financial instrument or to engage in any investment service or activity.

Journey Invest Limited accepts no duty of care or liability for loss arising from any person acting, or refraining from acting, as a result of any information contained within this article. All investment carries risk. The value of investments, and the income from them, can go down as well as up and investors may get back less than they put in. Past performance is not a reliable indicator of future returns.